Banking Operations, Reliable and Trustworthy

Edward Norton Bank and Trust in United Kingdom provides tailor-made services to cater to the needs of the diverse segments of the economy. We serve customers across the value chain of our commercial, corporate, and & investment banking divisions.

Simplify all your business financial transactions

At Edward Norton Bank and Trust, the leading bank in United Kingdom, we offer a variety of accounts to suit every individual and business need, regardless of your situation or lifestyle. Whether you're looking for a basic account or one with extensive features, you'll find the perfect account that meets your expectations.

We provide the best service for you

Edward Norton Bank and Trust is designed to provide easy and convenient access to your funds, because you have worked hard all month.

Super easy to use

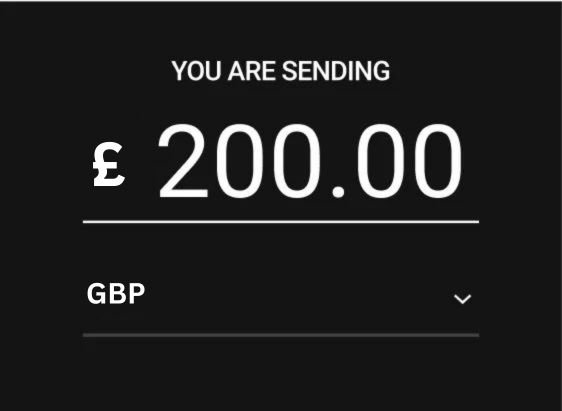

Send and recieve money efficiently

Safe and protected

Efficient transaction fees

Get the best services with the lowest fees

At Edward Norton Bank and Trust, the leading bank in United Kingdom, we believe that the beauty of life lies in the little things that give us a better expression of ourselves, make us more social, and connect emotionally.

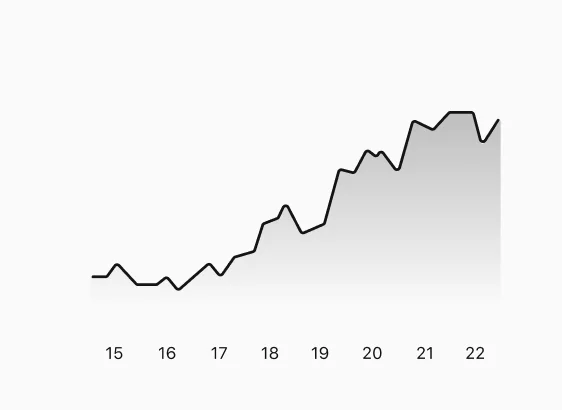

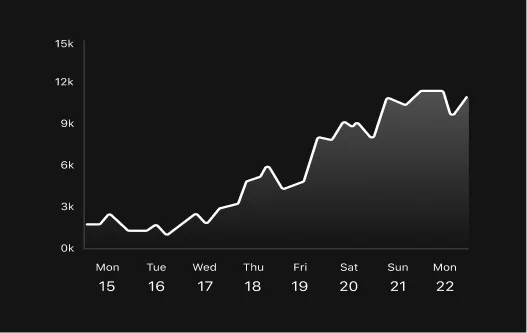

The maximum cashback fee for virtual account transactions is £49 for 8 months.

The program period runs from 14 December 2023 to 24 November 2024.

Transaction fees will be calculated when the merchant makes a transaction.

How Edward Norton Bank and Trust works

Edward Norton Bank and Trust has clearly distinguished itself in the banking industry through superior service quality, unique customer experience, and sound financial expertise. As the foremost bank in United Kingdom, we take pride in setting the standard for excellence in financial services, consistently going above and beyond to meet the diverse needs of our clients.

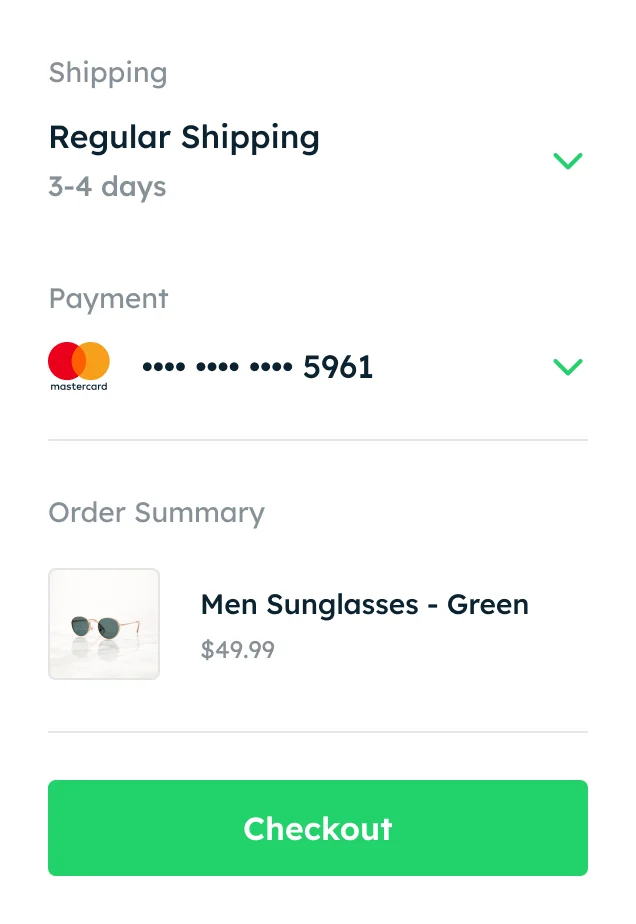

1. Register an Account

The Edward Norton Bank and Trust Account is recommended if you have a specific goal in mind or you just want to start setting money aside. This account offers interest on your funds regardless of the goal.

2. Verify Identity

At Edward Norton Bank and Trust we know that issues like security, protection from fraud and personal privacy, we make to sure to take extra steps by verifying customer identity with our state of art software

3. Start Transactions

Edward Norton Bank and Trust is designed to facilitate financial inclusion, permitting individuals with minimal amount of income to enjoy all benefits we offer. Enjoy a value adding banking relationship with us.

Reliable and Trustworthy

We help your needs to receive payments faster

Edward Norton Bank and Trust has clearly distinguished itself in the banking industry through superior service quality, unique customer experience, and sound financial indices.

- BANK TRANSFER

- CREDIT CARD

- DEBIT CARD

- VISA

- E-MONEY

- MOBILE MONEY

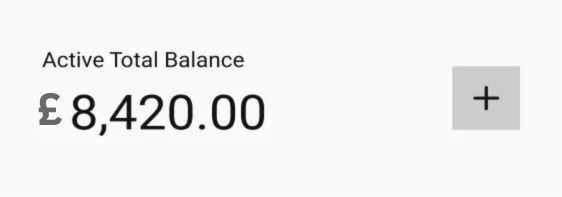

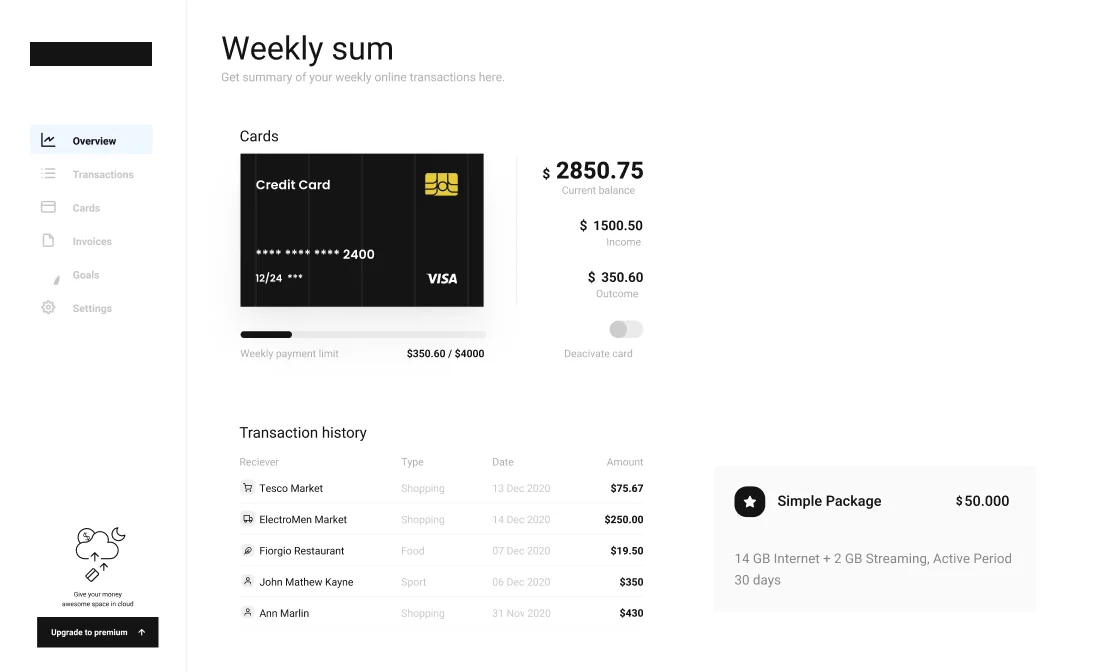

One dashboard for all business financial needs

Edward Norton Bank and Trust is designed to facilitate financial inclusion, permitting individuals with minimal amount of income to enjoy all benefits we offer. Enjoy a value adding banking relationship with us.

Easy to use

Super safe

We help your needs to receive payments faster

At Edward Norton Bank and Trust, we're proud to be recognized as the leading bank in United Kingdom. Our commitment to excellence shines through our exceptional service quality, unparalleled customer experiences, and robust financial expertise. We continually strive to exceed expectations, ensuring that every client receives tailored solutions to meet their unique financial needs.

Edward Norton Bank and Trust offers a variety of accounts, including personal checking and savings accounts, business accounts. We also provide specialized accounts for students and seniors.

You can open a new account online through our website or by visiting any of our branch locations. To open an account, you'll need to provide identification and other necessary documents. Our customer service representatives are available to assist you with the process.

Our interest rates for savings accounts and certificates of deposit (CDs) are competitive and vary depending on the type and term of the account. For the most up-to-date rates, contact one of our representatives.

If you lose your debit card or suspect any fraudulent activity, please contact our customer service immediately at support@edwardnortonbnkandtrust.com. You can also report the issue through our online banking platform. We will assist you in blocking the card and issuing a new one.

Edward Norton Bank and Trust strives to offer transparent and competitive fee structures. Fees may vary depending on the type of account and services used. Common fees include monthly maintenance fees, ATM fees for out-of-network withdrawals, and overdraft fees. For a detailed list of fees, please contact our customer service.

Contact our support team and they will help with all issues you are facing.